The age increase and consequently the rise of chronic conditions for clients, new medical technologies and demographic trends are the main reasons why private medical insurance premiums sensibly increased in recent years. Let’s explore some practical solutions to keep these costs under control.

4 reasons why private medical insurance premiums are increasing

1. More claims to pay than premiums received.

Insurance companies are for-profit organisations. In order to keep their books balanced, insurers adjust annually their tariffs depending on the results of their whole portfolio.

For example, if we pay 1,000 Euro each year in premium, but the bill of our recovery in hospital costed them 50,000 Euro, the following year our premium will not increase by 50,000 Euro but this increase will be applied “distributing” it on all clients.

This means that if the total amount paid out in claims in the 2015 is greater than the amount received in premiums from the clients in 2016, then the insurance company will automatically need to adjust its tariffs: so that the amount received is greater than the amount paid out.

2. The age of the clients.

Changing age bracket can significantly increase our insurance premium.

If we look at the UK, as an example, prices in the last 10 years have almost doubled. In 2015 they have rosen up by 6.5 %.

Why this happens?

Statistically, the healthcare consumption of individuals increases with age: cardiovascular diseases, cancer and respiratory problems are the three most frequent illnesses for which medical clinics receive request of recovery.

Therefore, even if we have not made any claims ourselves, our premium can increase simply because we have changed age bracket!

3. Medical inflation.

Medical inflation indicates the increase in the cost of drugs and medical treatments. It is generally much higher than normal inflation.

Let’s take in consideration MRI machinery: nowadays a scan is more expensive than it was 10 years ago. As the use of these new technologies becomes more frequent, insurers – to remain competitive within the market – are increasingly adding them to the benefit cover: consequently insurance premiums grow.

The cost of new medical technologies and drugs remains the primary cause of the high rate of medical inflation: this is why a discussion at European level with the European Federation of Pharmaceutical Industries and Associations is still open: drug pricing is at the top of the bill.

4. The demographic of those insured by our insurance company.

Healthcare costs for older clients tend to be higher. A well-known insurance company, which has been in the market for many years and with a loyal customers base, is much more likely to have a larger number of older clients than a newly established insurance company. Consequently, the premium rates will reflect this demographic factor and affect all the insured, even the younger ones.

How can we reduce the price of private medical insurance in 6 steps?

1. Quit smoking and prove your health.

Are you a smoker? If you are not, you are eligible to receive immediately a reasonable discount. In the future, more consumers will be asked to provide to the insurance companies their whole health information. Incentives for the digitizing and sharing of healthcare data along with improvements on technology of wearable devices are causing a big data revolution in healthcare: the goal is to receive a better healthcare at lower cost.

2. Select your country of residence.

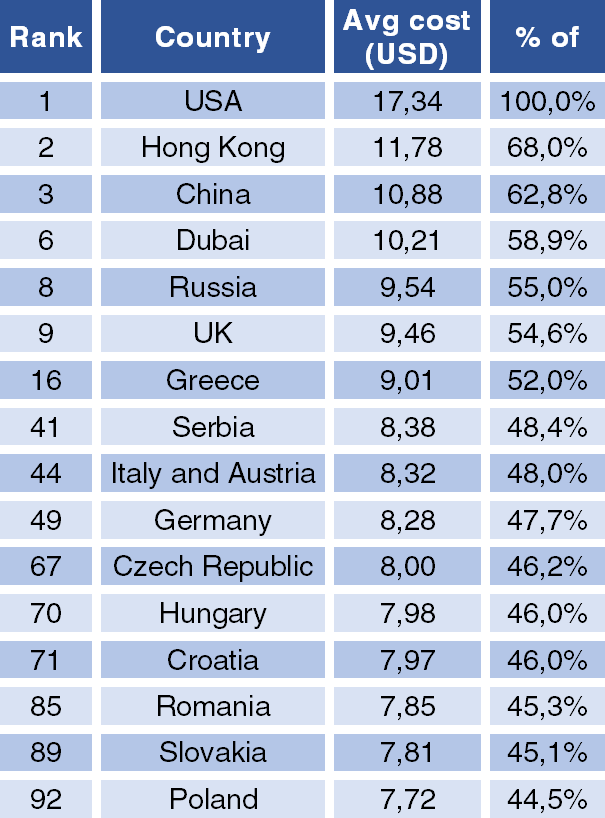

Medical inflation varies from country to country and from region to region. For example, it tends to be very high in countries such as Singapore, the Unites States, the Emirates. This is why insurance companies offer different zones of cover, and apply a tariff dependent on the zone that the client has chosen.

Russia is one of the most expensive countries where to buy medical coverage, followed by Greece, Spain, Italy and Germany.

Central and Eastern European countries like Poland, Slovakia, Romania, Croatia, Hungary and Czech Republic are at the bottom of the list. This is why having the residence in one of these countries can reduce our yearly premium and contribute to save our money.

3.Increase your deductible.

It is very simple. Each insurer gives the opportunity to choose the deductible for our medical plan. Having a plan without deductible offers, from one side, the possibility to receive full reimbursement. However, the premium will rocket to the sky. Instead, negotiating a reasonable deductible (approx. 1.500 to 3.000 Eur, depending on specific cases) will keep the yearly premium at a much lower rate.

4. Choose an in-network doctor.

Each insurance company has its own international network of clinics, worldwide. Insurance companies also are very keen on reducing hospital bills from their clients, negotiating prices with healthcare providers and ensuring that they are being charged fairly.

In case of emergency, it is always suggested to communicate to the insurer the clinic where we plan to be admitted. That clinic should be part of their network. If we are seeking to save money, we should never forget to look at the plan’s provider network: if our favorite doctors aren’t participating in the plan, we may face out-of-network charges.

5. Lobby for health insurance savings at work.

If we are covered under a group health plan through our working place, we may think we are stuck with whatever is offered, every year.

The advantage to work in a SME company is that our employer can go and search for better coverage options. There may be several “optional” benefits included in our group health plan that are causing our group rate to increase. If we and our co-workers agree that some coverage options are unnecessary (for instance, dental treatment), we can ask our employer to drop them at renewal time. Having a tailor-made coverage will contribute for sure to decrease the part of premium we have to pay.

6. Consult with a trustworthy risk manager to adjust your cover in order to reduce costs.

Each one of us represents a different case. We should regularly – preferably yearly – review our health insurance needs.

- Do we plan to change country of residence?

- Do we plan to have children, so that our partner would need maternity cover?

- Do we have already children that have special medical needs?

- Do we need any physiotherapeutic treatment and nursing assistance?

- Do we need an optional dental/vision/accident coverage to be included under our health coverage?

In conclusion

Better well-being leads to higher productivity. While the public sector and larger corporations have taken this on board and have in-house occupational therapists and other insurance schemes, SMEs, with smaller margins, start finally to buy into the idea.

An executive manager or a company owner, in case of emergency, needs to receive immediately quality helthcare services.

Choosing the right doctor – able to provide with a specific treatment for our case – makes the difference.